Standard medical plans often fall short for those with significant wealth. A better option to explore is "concierge medical insurance," which grants you access to top specialists, allowing you to have a dedicated support team from reputable institutions like the Cleveland Clinic or Mayo Clinic. These plans not only include experimental therapies, such as CAR-T cell treatment for cancer, but they also do not impose lifetime limits. It's crucial to seek global coverage: find a policy that offers air ambulance services to the nearest leading hospital, regardless of whether you are skiing in the Alps or vacationing in the Maldives. Some high-end plans even offer in-home care from elite doctors, ensuring a seamless and comfortable recovery right in your own space.

Critical Illness Insurance: More Than a Payout

A critical illness policy offers more than just financial aid; it is essential for maintaining your lifestyle as you recover. Select plans that give you a lump sum upon diagnosis, along with additional perks, such as a personal nurse for six months, mental health resources for both you and your family, or home adjustments to enhance accessibility after a stroke. If you have a business, consider options that can reimburse lost income during your treatment—up to 150% of your annual earnings—to reduce the financial burden on your enterprise. Avoid plans that have narrow definitions; ensure that the term “critical illness” includes less common conditions like ALS and multiple sclerosis, which are often excluded from standard coverage.

Accident Insurance: Tailored to Your Lifestyle

Standard accident insurance typically overlooks the unique risks linked to a luxurious lifestyle. If you participate in yacht racing or have a passion for classic car collections, it’s crucial to seek out policies that address "high-risk hobbies" to ensure you’re covered in case of injuries from these activities. For those who frequently travel abroad, it is wise to find insurance that includes emergency dental treatment while overseas or repatriation of remains—a necessary but difficult consideration. Some plans even offer perks for "lifestyle preservation." For example, if an injury from skiing stops you from golfing, the insurance may cover lessons specifically for you or even a custom-made golf cart.

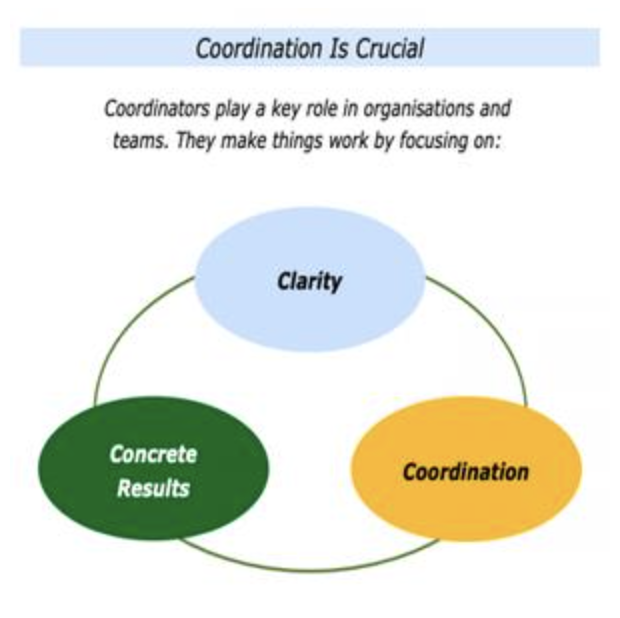

The Coordination Strategy

The most effective strategy is to use a mix of insurance types instead of depending on just one. Health insurance addresses your regular medical needs and major treatments, while critical illness insurance offers support during significant life changes, and accident insurance helps with unexpected injuries. For example, if you discover a heart problem, health insurance will pay for your surgery, critical illness insurance provides funds for you to take a year off work, and accident insurance can cover other unrelated injuries. It’s crucial to review your insurance annually; as your wealth grows, think about increasing your critical illness coverage to match your financial status, thus safeguarding your legacy properly.

For those with considerable wealth, insurance is not just about minimizing risks—it’s about handling how those risks affect your life. By choosing plans that suit your lifestyle, you can leverage insurance as a tool to preserve the lifestyle you have built.