"After thirty years of paying a mortgage, how often does life give us another chance?" This thought strikes a chord with those who own homes and carry the weight of lengthy loans. In a world full of unpredictability, mortgage life insurance stands out as a smart protection choice, particularly for those with greater financial means who are looking to plan their finances thoroughly.

Beyond the Basics: Understanding Mortgage Life Insurance

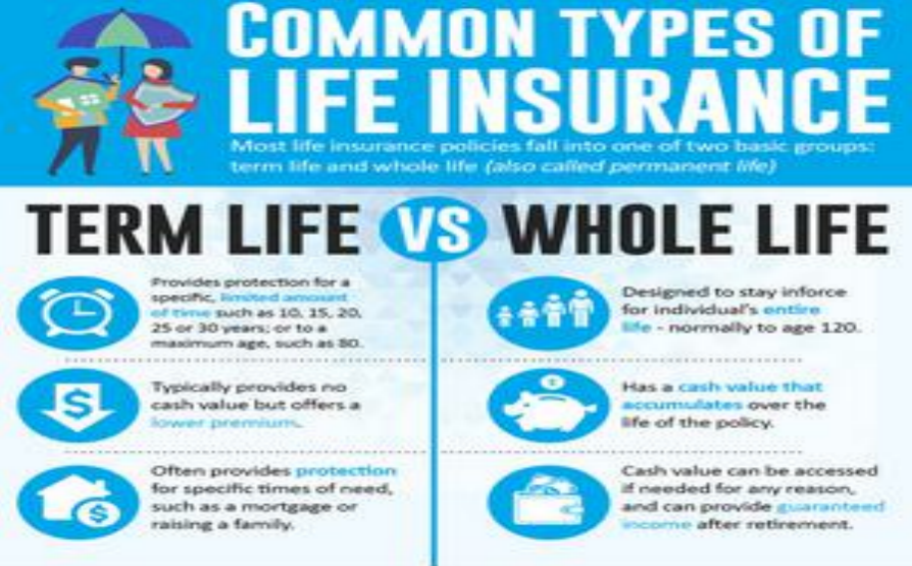

Mortgage life insurance differs from traditional life insurance by being designed specifically to pay off the mortgage balance if the borrower passes away or becomes permanently disabled. Although it may appear similar to standard life insurance, the way it distributes funds sets it apart – the money goes directly to the lender, which protects family members from the burden of mortgage payments.

For individuals with significant financial resources, whose homes are often valuable assets, this type of insurance offers a clear benefit. It not only helps maintain their family’s financial security but also protects their real estate investments. In a housing market where property values can change, having this protection ensures that the family can keep their home without facing the risk of losing it through foreclosure.

A Strategic Financial Move

Wealthy individuals recognize the significance of managing risks. Integrating mortgage life insurance into a well-planned financial strategy is key. This type of insurance serves as a way to prepare for potential debts. Rather than allowing mortgage payments to become a burden for their heirs, those with policies can facilitate an easy transition of property ownership.Additionally, for people involved in intricate financial dealings, like using real estate for business, mortgage life insurance provides reassurance. If unexpected events occur, it helps to maintain financial structures that depend on the mortgage’s stability.

Customized Coverage for Discerning Clients

Today, insurance companies provide mortgage life insurance plans that can be tailored to individual preferences. Clients with a strong financial position have the flexibility to select options that suit their unique requirements, like modifying the coverage amount to match potential property value increases or including add-ons for critical illness protection. This degree of customization permits policy owners to adjust coverage terms in accordance with varying interest rates or gradual repayment plans, ensuring that their policy adapts along with their financial situation. These personalized solutions fit well with estate planning and investment strategies, positioning them as essential components of thorough wealth management, which also allows for regular assessments to adjust coverage as property values or family needs change.

To sum up, mortgage life insurance serves more than just being a regular insurance option; it acts as a versatile financial resource that provides safety, stability, and reassurance. In an unpredictable world, particularly for individuals with major financial responsibilities, this protection helps keep the dream of owning a home alive. When confronted with market fluctuations or unforeseen life changes, these insurance plans function as a financial support system, safeguarding both the home and the family's future stability by connecting existing mortgage debts with changing financial objectives.