In a world where the quality and availability of healthcare differ greatly, expensive medical insurance often raises questions among wealthy individuals: Is it worth the high cost? For those with ample finances, instead of just looking at the prices compared to basic insurance, the focus shifts to how it meets their specific needs and improves their quality of life—issues that standard insurance often overlooks.

The Hidden Value Beyond Coverage

High-quality medical insurance goes beyond simply covering costs; it acts as a strategic asset that safeguards your most critical resources: your health, time, and mental well-being. For wealthy individuals, time is incredibly precious—delays of several months for a specialist visit or dealing with complicated claims can lead to lost chances and increased anxiety.

This service is not only about getting into private hospitals; it offers around-the-clock access to a worldwide network of top specialists who can give second opinions in just 48 hours, potentially changing the course of treatment. Picture yourself dealing with a difficult diagnosis while trying to finalize an important business deal—premium insurance plans provide a dedicated medical concierge who organizes your care, arranges appointments at convenient times, and can even facilitate medical travel with specialists if necessary.

Moreover, it offers proactive health measures that standard plans often ignore: yearly comprehensive health evaluations utilizing advanced technologies like whole-genome sequencing, personalized wellness plans created by sports medicine professionals, and management of chronic conditions with experts who focus on prevention rather than just treatment. These offerings do more than just address health issues—they enhance your overall well-being and may prolong your most productive years.

The Growth Potential of Strategic Investments

Education funds that focus on investments provide wealthy families with more growth opportunities and personalized options. Instead of traditional insurance with fixed returns, these funds invest in various assets like stocks, private equity, and real estate investment trusts (REITs), which tend to exceed inflation rates—important for the increasing education expenses of 5-7% each year at leading schools. They offer flexible funding options that can adapt to cash flow changes and allow easy access to funds without penalties for urgent expenses, such as prestigious summer courses. Savvy investors can also connect these funds to their overall financial plans through accounts that offer tax benefits.

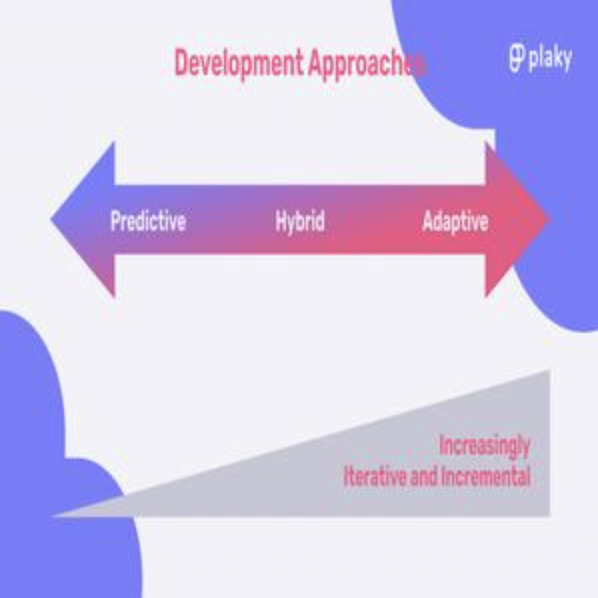

The Hybrid Approach: Balancing Security and Growth

Wealthy families have the option to mix education insurance, which covers necessary expenses such as tuition, fees, and basic living costs, with investment accounts that can meet changing needs like extracurricular activities, studying abroad, or advanced degrees. This strategy sets a financial safety net for essential expenses while allowing for growth that supports future goals—for instance, the insurance can take care of undergraduate tuition, while the investments can pay for an Ivy League master's program or a design school in Europe.

Tax and Legacy Considerations

Education insurance commonly provides life coverage, ensuring a payout if a parent dies, along with tax benefits (such as exemptions on educational expenses). Trust-based investment accounts assist in estate planning, allowing families to move wealth while managing how funds are used—supporting education and protecting assets for future objectives (like starting a business or buying a house). Global accounts give flexibility with currencies for studying abroad, helping to prevent risks from exchange rates.Wealthy families need both safety (insurance) and growth (investments) for education funding, adjusting to changing needs while enhancing their overall wealth plan.