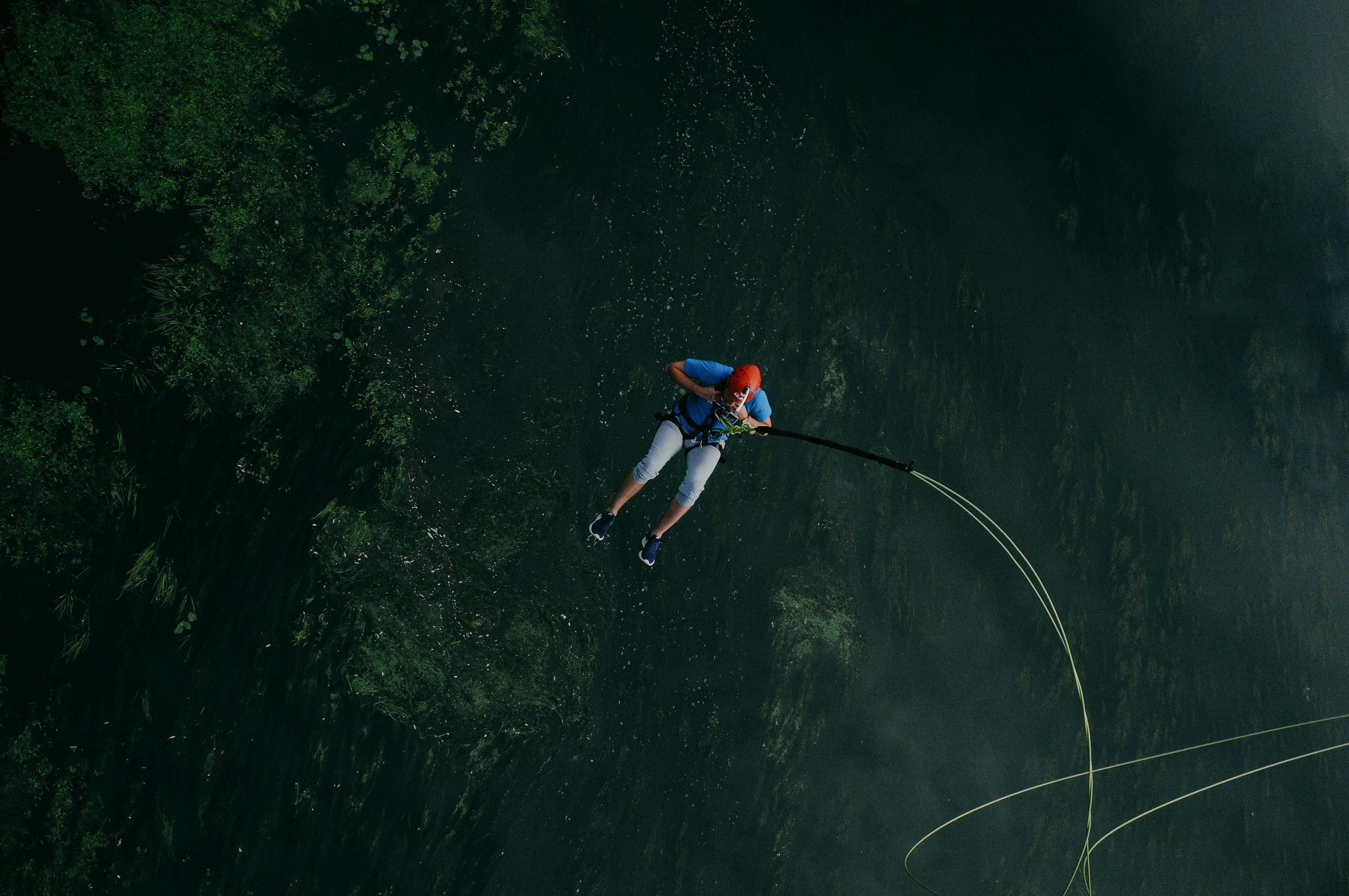

When gravity and adrenaline play a game at an altitude of hundreds of meters, bungee jumping, an extreme sport, is sweeping the global adventure enthusiasts with an annual growth rate of over 25%. However, what is hanging at the other end of the wire rope is by no means a simple thrill-data show that about 37% of bungee jumping accidents in the world are caused by equipment failures, and 26% are related to operational errors. As the invisible referee of this high-altitude game, professional bungee insurance is building an invisible safety net connecting the cloud and the ground with precise clause design and risk sharing mechanism.

"Gravitational Bundling Plan" is a common insurance model in the world bungee jumping industry, and its core lies in disassembling risks into static and dynamic modules. Static risks such as equipment inspection and platform stability are included in the commercial comprehensive liability insurance of bungee jumping operators; The dynamic risk of jumping moment is covered by personal accident insurance and special extreme sports insurance. This double insurance structure makes the guarantee cost of each jump account for 12%-18% of the fare on average.

It is worth noting that the price of bungee jumping insurance is not a simple linear calculation. In the evaluation, international actuaries will comprehensively consider the height of bungee jumping tower, the material of elastic rope (the risk factor of polyester rope is 34% lower than that of nylon rope), the qualification of operators (the accident rate of facilities with UIAA certification is as low as 0.07‰) and the health status of bungee jumpers themselves. This leads to the insurance cost of the same jump point, which may fluctuate up to 5 times due to individual differences.

In recent years, the emerging "cloud security protocol" is reshaping industry rules. Intelligent sensing equipment worn by bungee jumpers can monitor physiological indexes such as heart rate and gravity acceleration in real time. When the data deviates from the safety threshold, the system will automatically activate the emergency rescue plan. This integration of technology and insurance shortens the claim period from the average 48 hours in the traditional model to 15 minutes.

In addition to technological innovation, bungee jumping insurance is extending to the field of refined services. Some insurance companies have introduced a risk assessment system before bungee jumping, including health screening, psychological state assessment and professional jumping training. In Queenstown, the holy land of bungee jumping, the insurance company and the medical team jointly launched the "Gravity Impact Slow Release Plan" to provide participants with pre-jump decompression guidance, post-jump muscle recovery plan and helicopter rescue service in emergencies. This whole process guarantee mode from risk aversion to compensation afterwards is completely changing the safety ecology of bungee jumping industry.

The value of professional bungee insurance far exceeds the economic compensation itself. It forces industry standards to upgrade through sophisticated risk pricing mechanism; At the same time, risk pre-management is realized by scientific and technological means. At the moment when the acceleration of gravity reaches 9.8m/s, what really holds every heartbeat is this invisible but accurately calculated safety contract.