Cross-border transactions for pre-owned luxury goods—from vintage handbags and luxury watches to designer leather goods—have seen exponential growth, fueled by digital marketplaces that connect buyers and sellers across continents. Yet this global exchange is undermined by persistent pain points: disputes over authenticity, damage during long-haul transit, and misrepresentation of items (such as “like-new” pieces arriving with undisclosed wear). Standard shipping insurance or marketplace protection plans fall short here, often capping coverage at minimal amounts or excluding authenticity-related claims. Pre-Owned Luxury Goods Insurance for Cross-Border Transactions addresses these gaps, becoming a cornerstone of trust in a market where high value and cross-border complexity demand specialized protection.

A key strength of this insurance lies in its coverage of authenticity risks, a top concern given that counterfeit pre-owned luxury items account for a notable share of cross-border disputes. Policies partner with independent authentication firms—specialized in verifying brands like Rolex, Chanel, and Louis Vuitton—to inspect items before shipment. If an authenticated item is later proven counterfeit, or if a buyer provides evidence of inauthenticity from a mutually recognized firm, the insurer reimburses the full purchase price (often up to fifteen thousand dollars or twelve thousand euros) and may compensate sellers for lost inventory. This protects buyers from costly scams and sellers from unfounded authenticity claims that harm their reputation.

The insurance also fully covers transit damage, a risk amplified by international shipping’s multiple handling points and varying customs processes. Unlike basic shipping insurance, which might only cover two hundred euros or three hundred dollars, this policy covers the item’s full appraised value—whether it’s a three thousand euro pre-owned Gucci wallet or a twenty thousand dollar vintage Cartier bracelet—for issues like torn leather, cracked watch faces, or lost components. Some plans even include delay coverage, reimbursing buyers for customs storage fees or missed gifting deadlines if shipments are held up unexpectedly.

Additionally, it mitigates risks from transaction disputes, such as when a buyer claims an item does not match the seller’s description (e.g., incorrect size, hidden scratches). Instead of forcing parties into lengthy legal battles, the insurer acts as a mediator: valid claims (backed by photos, appraisals, or authentication reports) trigger prompt reimbursements for buyers, while sellers receive support to recover the item or recoup partial value, avoiding negative marketplace feedback.

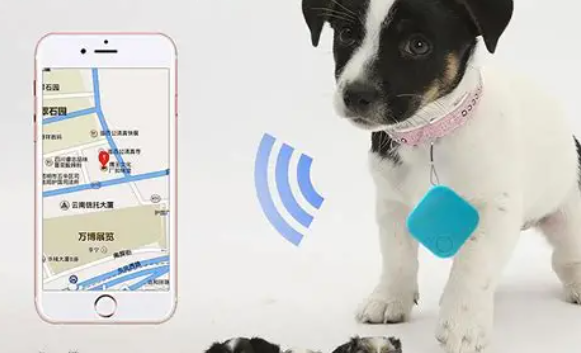

To streamline processes, the insurance integrates closely with global logistics providers and authentication networks. Sellers submit items to approved authentication firms for a certificate, shared with buyers and insurers to confirm legitimacy. Shipments are tracked via GPS, with carriers prioritizing insured luxury goods. Valid claims are processed within 72 hours, far faster than standard insurance, minimizing financial strain for both parties.

For the pre-owned luxury market, this insurance is more than a safety net—it drives growth. By reducing uncertainty, it encourages buyers to shop internationally and sellers to expand beyond local markets. A seller listing a pre-owned Prada coat from a European city can now trust transactions with buyers in North American hubs, while buyers feel secure investing in high-value items sight unseen. In a market where trust is as valuable as the goods themselves, this insurance turns cross-border pre-owned luxury transactions from a risky endeavor into a reliable, accessible opportunity.