The policy allowing families to have three children has changed how many wealthy households are structured, creating both happiness and complicated issues. For families with significant wealth, having a third child means more than just higher monthly costs; it involves securing future possibilities, strengthening parenting skills, and maintaining wealth across generations. To address these complexities, families need more than simple insurance; they require carefully planned protection strategies designed for families with multiple children.

Education Continuity: Beyond Tuition

Families that aim for success often focus on tailored educational options—such as private institutions, global programs, or specialized training—which can last for decades and cater to three children. Standard savings methods frequently do not adjust to evolving requirements, like a child suddenly wishing to study STEM overseas, another showing interest in the arts, or unanticipated tutoring expenses. Tailored education insurance addresses this challenge by offering flexible payout options that release funds at important stages (like middle school, college, and postgraduate education) while allowing for necessary adjustments along the way. Additional features ensure support even when parental earnings vary, protecting educational avenues no matter the ups and downs of employment or business. For families that are globally mobile, these solutions work well with international education systems, bridging any tuition gaps during relocations.

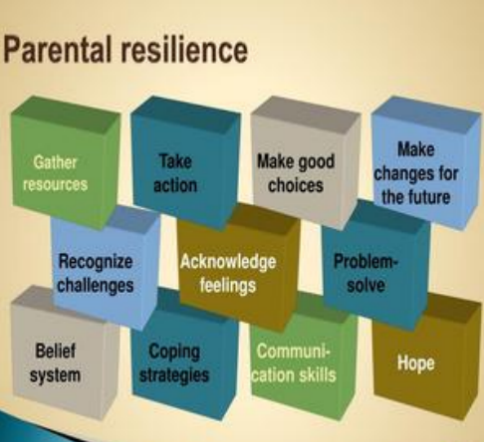

Parental Resilience: The Overlooked Foundation

When there are three children in a family, the responsibilities for parents increase significantly, leading to higher stress and potential health risks that can disrupt family stability. Parents who earn a lot often face the challenge of balancing work and caregiving, which makes their health and income vital assets for the family. Nowadays, health insurance for parents often includes benefits for “caregiver wellness,” such as mental health support, comprehensive health check-ups, and temporary care services to help avoid exhaustion. Additionally, income protection insurance must adjust according to the number of family members, providing 80% of income (including bonuses and stock options) for longer durations. This ensures that obligations like mortgages, education savings, and other living expenses are maintained during times of parental illness or injury. These insurance plans differ from standard ones as they consider the longer recovery periods that parents with several children typically face.

Legacy Balance: Equitable Asset Distribution

Families with multiple children encounter distinct challenges regarding inheritance, ranging from differences in educational contributions to conflicts over assets. Insurance can subtly help to manage these issues. By integrating permanent life insurance with a trust, parents can allocate money for each child's particular requirements—such as a share in a business for one, a down payment on a house for another, or a fund for graduate studies for the last—without diminishing their available cash. Additionally, parents can benefit from critical illness insurance that includes “legacy acceleration” riders, which guarantee quick access to funds upon diagnosis, preventing any delays that might interfere with their children’s life events. Such arrangements promote fairness and clarity, ensuring that each child's unique journey is respected and valued.

Flexibility: Adapting to Evolving Needs

As three children grow, family dynamics change significantly, which requires the Guarantee Plan to adapt. Parents can utilize modular insurance plans to modify their coverage as their kids age: enhancing health benefits during adolescence, incorporating auto insurance options when they start driving, or reducing education funds when some children achieve independence. For families with a business, life insurance tied to the company not only offers protection but also supports growth, with cash values that can cover both children's needs and business investments, blending personal and professional objectives.

Families with three children flourish when their protection suits their complexities. For wealthier homes, this involves moving beyond standard plans to tailored strategies that ensure education, parental stability, legacy value, and flexibility—providing a balance between growth and security.