When it comes to protecting wealth, two main elements play a crucial role: insurance and savings. For individuals with significant assets who want to ensure their wealth remains secure, the focus is not on choosing one over the other, but rather on how these different resources work together to safeguard finances from unpredictable events. Savings create a solid base of available cash and potential growth, while insurance serves as a protective barrier against major risks that can damage even the strongest portfolios. Together, they create an effective strategy—each fulfilling a specific purpose in maintaining your financial legacy.

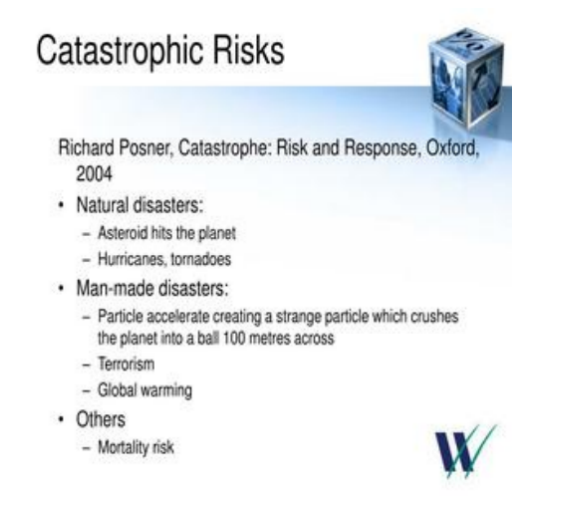

The Shield of Insurance: Deflecting Catastrophic Risks

Insurance provides crucial support where savings may fall short, safeguarding against potential threats that could lead to loss of wealth in an instant. For wealthy individuals, these dangers not only include health emergencies but also encompass liability issues, business interruptions, and risks to their estates. For instance, high-level umbrella policies offer protection for personal property against lawsuits arising from various incidents, including accidents or professional errors. The expenses in these situations can quickly surpass standard savings. Furthermore, specialized insurance for valuable assets protects unique collections, luxury properties, and intellectual creations from damage or theft. The replacement costs for such treasures often far exceed normal savings. Most importantly, life and critical illness insurance ensures immediate financial support when unexpected tragedies occur, preventing the need to sell off assets during market declines to meet expenses. This possibility could significantly erode wealth passed down through generations.

The Foundation of Savings: Growth and Liquidity

When used wisely, savings can act as a source of growth and a flexible resource for both opportunities and small emergencies. Wealthy savers utilize a variety of investment options—from private equity and real estate to high-yield accounts—that not only keep ahead of inflation but are also easy to access. Unlike insurance, which usually needs certain conditions to access funds, savings provide immediate cash for anything from taking advantage of a quick investment opportunity to paying for a child’s education or addressing sudden home repairs. This availability of funds also serves as a mental safety net, allowing individuals to feel secure while taking smart risks in business or charity. For preserving wealth, savings cultivate strength against slow-moving dangers such as market changes or increased living costs, accumulating value over time to reinforce your financial stability.

Synergy in Action: The Optimal Balance

When insurance and savings work together effectively, they create strong portfolios. Insurance protects savings from large crises, while savings help pay for deductibles, cover premiums, and support living expenses during times when one is waiting for insurance. For instance, a solid emergency fund can manage short-term costs related to property loss, and insurance takes care of the long-term reconstruction. Moreover, saving for permanent life insurance premiums leads to tax benefits that enhance other investments, making sure no single risk can threaten the security of assets.

Beyond Protection: Crafting Legacy Resilience

For wealthy individuals, protecting assets is about making sure that their legacies last. Insurance helps to pass on wealth using methods like trusts, while savings contribute to the main funds for family projects. When used together, they form a system: insurance protects against losing wealth, and savings help to increase it, ensuring that assets can face difficulties and flourish.In the end, insurance and savings work hand in hand, playing a vital role in a plan that secures what you have built and supports its expansion.