"Cancer does not mean the end; it is poverty that truly brings despair." This harsh truth highlights why critical illness insurance is essential. For wealthy individuals, the focus isn't solely on money; it's also on preserving a good standard of living during times of health issues. Let’s explore how to understand the intricate aspects of critical illness insurance.

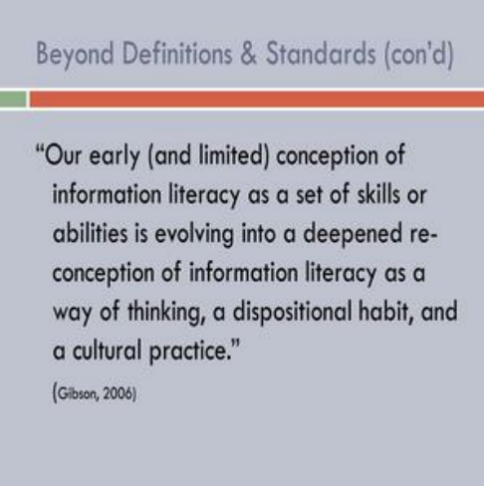

Look Beyond Standard Definitions

Standard policies frequently limit the definition of "critical illness," putting policyholders at risk. Those with high incomes should look for insurance providers that offer more inclusive definitions. For example, some forward-thinking insurers now include early-stage cancers, like stage 1 thyroid cancer, among their covered illnesses.They additionally offer protection for less common yet grave ailments like severe rheumatoid arthritis.This all-encompassing perspective helps protect policyholders from a wider array of health risks. By carefully examining the details of policy definitions, you can prevent the issue of being underinsured when confronted with unforeseen medical challenges.

Customize Your Coverage

General policies aren't sufficient for wealthy clients. Tailoring your policy to align with your unique lifestyle and risk profile is paramount.For those who often travel internationally or have a family history of certain genetic conditions, adding riders for experimental therapies or overseas medical services is extremely beneficial. These riders can provide access to innovative treatments unavailable in your country, like advanced immunotherapies for cancer offered at specialized facilities abroad. Furthermore, look for policies that offer high coverage limits. Imagine needing intricate heart surgery followed by extended rehabilitation; a high coverage limit can help manage not just the medical bills but also any lost income during recovery, ensuring you have the necessary financial backing for ongoing care and a smooth return to everyday life.

Prioritize Policy Flexibility

Life can be full of surprises, and so can our health requirements. Choose insurance providers that offer the option to modify your policy as needed. Important life changes, like getting married, welcoming a new child, or changing jobs, can impact your health and finances. A policy that allows flexibility lets you enhance your coverage when new responsibilities arise or change plan types as your needs evolve. For instance, as you grow older and focus more on your well-being, you might move from a basic critical illness plan to one with added wellness features. This kind of flexibility helps your insurance to match your changing situation.

Assess Insurer Credibility

The importance of financial strength in critical illness insurance is greater than ever before. It is essential to carefully investigate an insurer's claims settlement ratio and their ratings for financial stability. A trustworthy provider ensures that claims are paid quickly and also includes valuable services such as concierge medical assistance. These additional services can significantly simplify the daunting process of finding excellent healthcare. They assist in making appointments with top specialists, managing intricate hospital procedures, and obtaining second opinions. Insurers known for their strong financial stability are more reliable in the long term, giving you reassurance that your coverage remains safe and secure.

Leverage Technology

Today's insurance companies utilize data analysis and artificial intelligence to create personalized policies. For individuals with high incomes, it’s advisable to seek out providers that offer digital health services like genetic risk evaluations and telehealth appointments. These genetic evaluations help pinpoint potential health issues based on your genetic material, enabling you to take early action to prevent or manage specific health conditions. Conversely, telemedicine consultations ensure prompt access to healthcare professionals, a distinct advantage for individuals with hectic schedules. These technology-based features not only improve preventive healthcare but also tailor coverage to align with individual health needs, ensuring that your policy fits your unique circumstances.

As healthcare expenses continue to rise, critical illness insurance emerges as a smart investment for wealthy individuals. By exploring options beyond standard coverage, personalizing your plans, and selecting trustworthy providers, you can turn this safety net into an effective means of safeguarding both health and financial stability. Always remember, real comfort comes from the assurance that you are secure—regardless of what lies ahead.