People often ignore accident insurance because they prefer more exciting policies, viewing it as just simple coverage for small accidents. However, for successful professionals with dynamic lives, this usually neglected insurance is essential for thorough risk management. It not only pays for medical expenses related to injuries like fractures or strains but also ensures you can keep your lifestyle, protect your belongings, and maintain your income—proving to be more important than many think.

Lifestyle Continuity: Beyond Medical Expenses

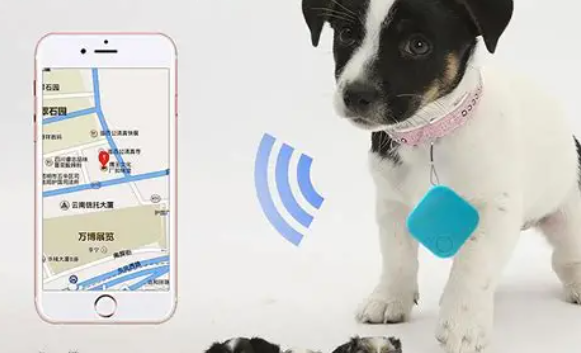

An active lifestyle, filled with skiing weekends, adventurous traveling, and competitive sports, brings happiness but also higher risks. Premium accident insurance offers more than just basic health coverage; it addresses the comprehensive effects of injuries. For example, if you were to injure your ACL while running in a charity marathon, your health insurance may cover the surgery, but specialized accident insurance would help pay for private physical therapy that suits your schedule, necessary home modifications like temporary stairlifts, and even transportation options to help you commute to work during your recovery.For wealthy individuals, these policies provide “lifestyle preservation” features. They cover the costs of hiring temporary help for household tasks, pet care when injuries limit movement, and even replacement tickets for pre-booked trips that accidents disrupt. This means that a single incident won’t compromise your quality of life or force you to give up the activities you enjoy.

Career Protection: Safeguarding Earning Trajectory

A break in your work due to an accident can lead to financial issues in the long run, particularly for those in fast-growing fields. Comprehensive accident insurance offers “career continuity” features that help safeguard your professional path. This can include covering expenses for temporary staff to handle your responsibilities while you recover, enabling virtual participation in key industry events that you might miss, or even supporting courses to maintain your skills during a lengthy absence.

If you are a business owner or an executive, this insurance also covers losses from business interruptions when an accident stops you from managing important tasks. For instance, a 35-year-old tech entrepreneur who experiences a cycling accident could utilize these benefits to pay for temporary leadership assistance, ensuring that product launches proceed as planned and that investors remain confident.

Asset and Liability Shield

Assets and properties of high value come with specific risks related to accidents that regular insurance policies often overlook. For instance, specialized accident insurance takes care of liability costs if a guest is injured on your property, covering everything from legal fees to settlement payments that could endanger your assets. This type of coverage also safeguards valuable equipment—such as photography tools damaged in a hiking incident or high-quality sports gear needing repairs after an accident.

If you lead an international lifestyle, global accident insurance provides steady protection across different countries, offering emergency medical evacuation from isolated areas, support for claims in various languages, and coverage for accidents during business trips that local insurers might exclude. This worldwide service is essential for professionals who navigate multiple nations and currencies.Accident insurance for those with significant earnings is not merely a basic requirement; instead, it serves as a strategic asset that links physical safety to financial well-being. It protects against the impact of unforeseen events that could derail your career progress, force you to make lifestyle changes, or jeopardize your assets. By understanding the wide range of protection it offers, you’ll see why accident insurance should be a primary focus in your approach to risk management—not just an afterthought, but a crucial safeguard for the life you’ve created.