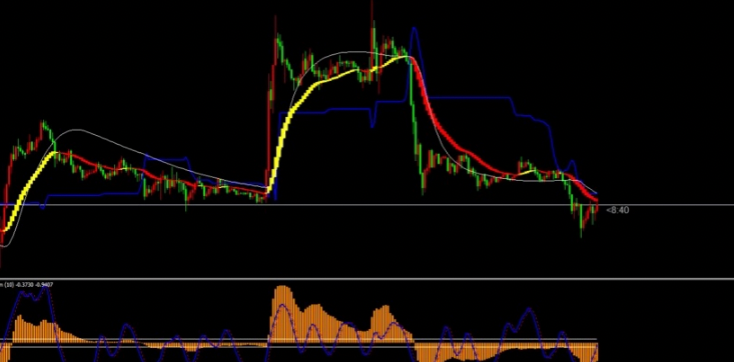

If your futures trading system has been determined, then the next important question is how to choose an optimal trading cycle. The choice of the trading cycle is more commonly known as the question of how long to do the K-line, whether it is a 1-minute line, 3-minute line, 15-minute line, 1-hour line or daily line. The optimal period of choice is not a very good solution to the problem, the optimal solution to the problem is very dependent on the choice of data, the trend is divided into simple and complex trends, and consolidation is also divided into narrow and wide consolidation, not the same market background of the optimal choice is not the same, but our actual operation is not possible to know what the nature of the market, you can only choose an operating cycle.

This article suggests that investors should follow the following principles when choosing the optimal cycle: First, they need to choose more comprehensive data. This is because the data needs to include at least one simple trend and one complex trend each. In addition, there needs to be a wide broadening consolidation and a wide consolidation, a large V-reversal, a narrow broadening consolidation, a narrow consolidation, and a small V-reversal. Not only because these eight quotes are more comprehensive and accurate as they can cover all the market movements in nature.

Secondly, the time comparison between trend and consolidation is kept roughly based on one to three, because the price is doing consolidation movement most of the time, and some information says that the market is doing consolidation movement about 70% of the time, so it is appropriate to choose the number of trend consolidation at one to three. The final requirement is that the data type above is the minimum requirement. If there is to be stability, it is best to have three times the minimum requirement of these eight quotes. Of course, this requires a high time length of data, and many current quotes software short period of the maximum amount of data will not meet the requirements. For example, the maximum data of some social software for 1 minute is only 2 months, so to fully optimize the selection you must collect or buy professional data yourself. It is also important to note that the number of futures simulation trades should be stable. The more times you trade, the more stable your trading data will be, so you should trade as many times as possible to stabilize your trading data.

According to the above general statistics for trend and consolidation, at least 30 trades are required for trend trades and 100 trades for consolidation. Investors should also determine the optimal period and then not change it in the actual trading. According to the above requirements to determine the optimal trading cycle, do not change the optimal cycle in the actual trading according to the recent trading situation, because the previous optimal is the optimal answer for a variety of different natures of the market, but most likely not the optimal solution for the current market, the use of long-term optimal solution requires long-term persistence, do not give up because of the short-term performance is not good.