The recently released U.S. inflation data for October was significantly lower than market expectations, with both headline and core inflation improving more than expected on a year-over-year basis and the first time in the past six months or so that inflation has improved more than expected.

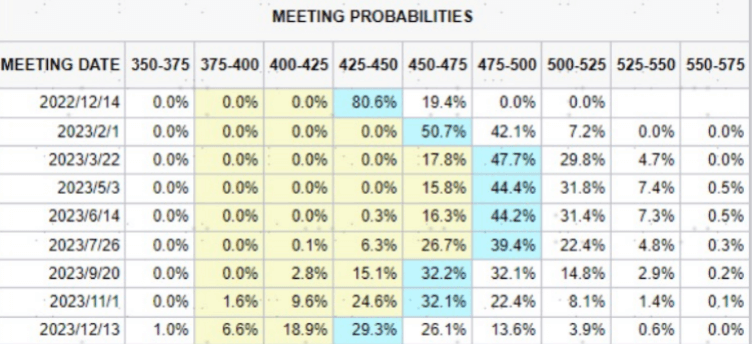

This change is positive, so the market seems to have received the light of inflation and may fall back. Driven by this, U.S. bond rates sharply lowered to about 3.85%, the dollar fell back to below 108, U.S. stocks S&P 500 index jumped 5.5%, 5%, and the probability of a 50bp rate hike in December rose to 80%. This performance is déjà vu in July this year when the market is expected to ease inflationary pressures and even expect a rate cut in the middle of next year, when U.S. bond rates fell sharply back to 2.5% and U.S. stocks rebounded sharply in the market. So, what are the implications for the future direction of monetary policy and asset performance if this unexpected improvement in inflation can become a definitive inflexion point?

Under this inflation path, this article expects that: in the period between now and the end of next year, the Fed policy path can be divided into three development trends: the next one or two meetings may first retreat, and then by the first quarter of next year when the action of raising rates is stopped. To the second half of the year, rate cut expectations rise and may even turn to rate cuts. Late this year or early next year, nominal interest rates top out and long bonds gradually usher in an allocation window. Step 2: Rate hikes stop. In the first quarter of next year, inflation falls further back to 4-5%, the Fed rate hikes into the end, and nominal interest rates down to open up more space; but at this time need to pay attention to the recessionary pressure to raise the pressure on the molecular end of the stock market. The third step, interest rate cuts are expected to heat up. Recessionary pressure, this paper predicts that in the first two quarters of next year or so, easing expectations heating up to promote the rapid decline in real interest rates, gold and growth stocks gradually ushered in the allocation of time. Therefore, the overall rotation of the order of the current cash to treasury bonds, and then to gold and growth stocks. But the two "dark clouds" behind this, one is the Fed's rate hike path on the matter itself, such as whether Powell still adheres to the November FOMC meeting on the path of interest rate hikes; the second is the magnitude of interest rate hikes in financial conditions on the pressure on growth.

The former may make the downward movement in financing costs delayed, while the latter puts more pressure on stock market earnings by depressing growth. Inflation remains the most problematic issue for the current state of affairs in the US. In an environment where U.S. investment returns have started to fall (recessionary pressures) and are below financing costs need to be responded to by a timely fall in financing costs or monetary policy, or face greater downward pressure on growth.