Pet GPS trackers have become a staple for owners seeking peace of mind, letting them monitor their furry companions’ locations, activity levels, and even health metrics remotely. Yet, many owners overlook two critical risks: damage or loss of the tracker itself, and potential breaches of the sensitive data these devices collect. Standard pet insurance rarely covers electronic accessories like GPS trackers, and general home insurance often caps coverage for small tech items at amounts too low to replace high-quality models. Meanwhile, data privacy concerns—from unauthorized access to pet location histories or owner contact details—remain unaddressed by most insurance products. This gap has made Pet GPS Tracker & Data Protection Insurance a vital resource for owners who want to protect both their investment in pet tech and their privacy.

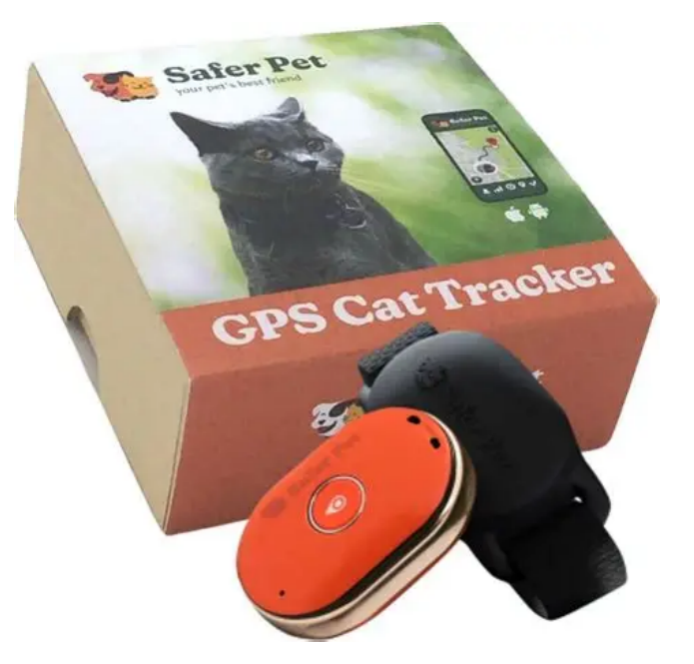

The insurance first addresses physical protection for the GPS tracker, covering scenarios that are common in daily use with pets. This includes accidental damage, such as a tracker getting crushed during a dog’s outdoor play or submerged in water during a walk in the rain, as well as theft or loss (e.g., a tracker falling off a pet’s collar and going missing). Unlike basic coverage, which may only reimburse a fraction of the tracker’s cost, this specialized insurance typically covers the full replacement value—ranging from two hundred dollars for entry-level models to eight hundred dollars for advanced trackers with health monitoring features. It also includes coverage for accessories like charging docks or replacement collars, which are often necessary to keep the device functional but rarely covered by other policies. For owners who rely on the tracker to locate escape-prone pets, this protection ensures they don’t face unexpected costs to replace a device that could mean the difference between finding a pet quickly and a stressful search.

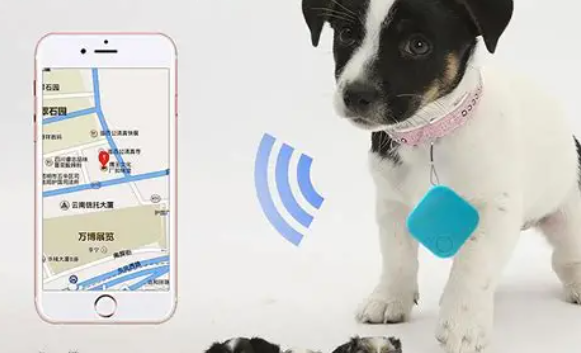

Beyond physical device protection, the insurance tackles data privacy risks, a concern amplified by the connected nature of modern pet trackers. These devices collect and store data like real-time location data, pet activity patterns, and even owner addresses or phone numbers—information that could be misused if accessed by third parties. The insurance covers expenses related to data breaches, such as fees for identity theft monitoring services if owner information is compromised, and legal costs if the owner needs to address unauthorized use of their data. It also includes support for data recovery or deletion if the tracker is stolen, helping owners prevent their pet’s location history from being misused. Some policies even partner with cybersecurity firms to conduct regular audits of the tracker’s data security, reducing the risk of breaches in the first place. This level of protection is especially valuable given that many tracker manufacturers offer limited data security guarantees, leaving owners vulnerable to privacy violations.

Insurers have designed these policies to be flexible, adapting to different types of trackers and owner needs. For example, policies for outdoor-focused trackers (used for hiking or camping with pets) may include additional coverage for damage from extreme weather, while those for indoor trackers (for cats or small dogs) might prioritize theft protection. Premiums are typically affordable, ranging from one hundred twenty to two hundred fifty dollars per year, a small cost compared to the expense of replacing a high-end tracker or addressing a data breach. Many providers also offer bundled benefits, such as free annual device maintenance checks or discounts on replacement accessories, adding further value for owners.

When selecting a policy, owners should focus on two key factors: coverage limits for both the device and data protection, and clarity on exclusions (e.g., whether damage from intentional misuse is covered). It’s also important to confirm that the policy works with the specific brand or model of tracker, as some insurers may have partnerships with certain manufacturers to streamline claims. By choosing a policy that aligns with their tracker type and privacy concerns, owners can ensure they’re fully protected—letting them focus on enjoying time with their pets rather than worrying about device damage or data risks. In a world where pet tech plays an increasingly important role in keeping companions safe, this insurance bridges the gap between innovation and security, offering owners the confidence to use these tools without compromise.