For affluent individuals building diverse financial portfolios, insurance acts as both protection and a plan. Yet, the guidance offered by agents often misses key details that might influence your decisions. These important facts, rarely mentioned in discussions, deserve careful consideration before committing to costly policies.

Liquidity Isn’t as Guaranteed as They Suggest

Permanent life insurance policies are often promoted as "liquid assets," but agents frequently overlook the true challenges of accessing these funds. If you decide to cancel your policy within the first ten years, you may find that your returns are very low—usually less than 20% of the premiums you’ve paid—due to high surrender fees that gradually decrease over 10 to 15 years. Furthermore, while it may seem easy to take out loans against your policy, this option has its drawbacks: every loan you take reduces the death benefit by the same amount, and if you don’t pay the interest, it can pile up and reduce the policy's value. Wealthy clients seeking quick access to cash for investments or emergencies often discover these constraints only when they need liquidity the most.

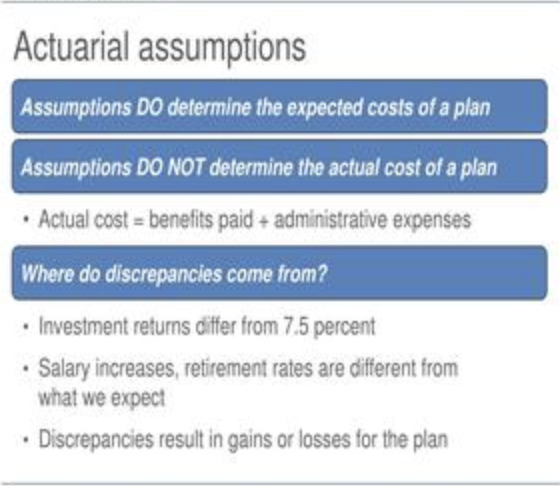

Actuarial Assumptions Are Far From Certain

The advantages and guarantees found in complex insurance policies rely on actuarial models that agents rarely explain clearly. Consider variable universal life policies; they frequently advertise “projected returns” of 6-8%. However, these estimates assume perfect market conditions and ignore historical ups and downs. As a result, in reality, the returns might be lower than anticipated by 2-3% due to market downturns and additional internal fees. Moreover, agents often fail to mention adjustments in mortality predictions. Since people are living longer, insurance firms gradually increase their prices to remain profitable, which can decrease the actual value of the policy over time. These changing elements suggest that the policy you were sold might not deliver the expected outcomes after several years.

High-Cost Riders Rarely Justify Their Price

Riders that are expensive often fail to deliver genuine advantages. Wealthy clients often prefer long-term care riders, but these come with strict rules—such as a 90-day waiting period and particular conditions—and they deny 30% of early claims over small problems. The extra 20-30% in payments usually outweighs the benefits provided, whereas standalone policies offer better protection at a lower cost. Agents usually miss this point since bundled riders boost their commissions.

Your Agent’s Authority Has Hidden Limits

Promises from agents about “exclusive coverage” or “special exceptions” often mask their shortcomings. They lack the ability to adjust the terms or alter the decisions made by corporate underwriters. Guarantees concerning medical issues or pricing may unravel during assessments, causing clients with complex backgrounds to encounter higher premiums or exclusions that agents are powerless to fix.

Policy Adjustments Have Unexpected Consequences

Modifying policies can sometimes create unforeseen issues. Lowering the premiums on permanent policies may cause tax implications or hinder the growth of cash value. Should you wish to enhance your coverage in the future, it will necessitate a fresh underwriting process, potentially leading to increased rates if your health has declined. Moreover, altering beneficiaries or ownership for estate purposes might trigger tax problems or create gaps in coverage. Agents rarely advise seeking independent assessments for these alterations. For affluent clients, it is essential to scrutinize insurance beyond mere claim amounts. Being aware of these details ensures that your coverage aligns with long-term goals instead of just sales objectives. Ask for clear explanations regarding costs, restrictions, and future outlooks before making any choices.