Novice drivers in Europe and America—typically aged 20-40, many navigating their first cars post-license—often face a frustrating barrier: disproportionately high premiums for traditional car insurance. Insurers classify new drivers as high-risk due to limited on-road experience, translating to costs that can strain budgets, even for basic coverage. Enter Usage-Based Car Insurance (UBI), a innovative model that ties premiums to actual driving behavior rather than generic risk profiles, offering a fairer, more affordable alternative for those just starting their driving journeys.

UBI operates on a simple yet data-driven principle: it uses telematics technology—small devices plugged into a car’s OBD port, smartphone apps, or built-in vehicle systems—to track key driving metrics. These include annual mileage (the most basic factor), driving time (e.g., avoiding high-risk night hours), acceleration and braking patterns (sudden moves signal inexperience), and adherence to speed limits. Unlike traditional policies, which rely on broad factors like age or location, UBI rewards new drivers for safe habits: a driver who only uses their car for short weekend trips and maintains steady speeds will pay far less than one with frequent rush-hour commutes and erratic braking.

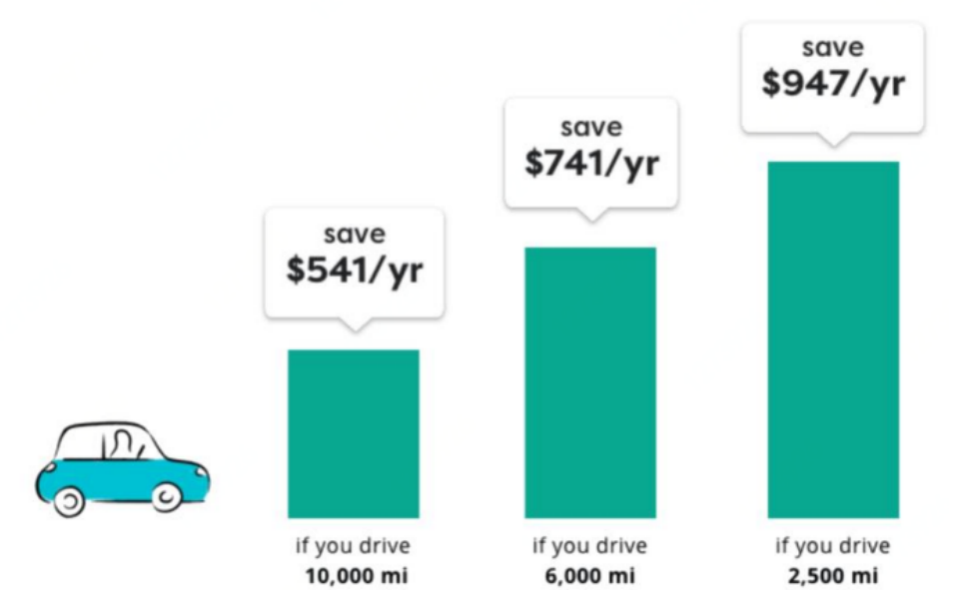

For young new drivers, this model delivers two critical benefits. First, it reduces upfront costs: UBI policies often start with a low base premium, with additional charges calculated based on actual usage. A 25-year-old in Berlin who drives 5,000 km yearly might see a 30-40% reduction compared to a traditional policy, while a 30-year-old in California using their car primarily for grocery runs could save even more. Second, UBI acts as a “driving coach”: many providers share real-time feedback via apps, helping new drivers identify and correct risky habits—ultimately making them safer on the road and building a positive insurance history that lowers future premiums, even if they switch back to traditional coverage.

The UBI market has expanded rapidly across Europe and America, with tailored options for new drivers. In Europe, providers like Admiral’s LittleBox (UK) and Allianz’s DriveSmart (Germany) offer user-friendly apps and transparent pricing, while in the U.S., Progressive’s Snapshot and Allstate’s Drivewise are popular for their flexible mileage-based plans. Notably, some UBI policies also include “pay-as-you-go” features, ideal for new drivers who only use their cars occasionally—such as students or remote workers—eliminating the waste of paying for unused coverage.

When choosing a UBI policy, new drivers should prioritize three factors: data privacy (ensure insurers clearly outline how they store and use driving data), coverage limits (confirm it meets local legal requirements and protects against common risks like collisions or theft), and feedback tools (opt for providers that offer actionable insights to improve driving). It’s also wise to compare quotes: while UBI is generally cheaper, premiums vary by insurer and driving habits.

For new drivers in Europe and America, UBI is more than just cost-saving—it’s a vote of confidence. By rewarding safe, responsible driving, it breaks the cycle of high premiums for inexperience, making car ownership accessible without sacrificing financial security. In a world where fairness matters, UBI isn’t just an insurance option—it’s a smarter way to start a lifetime of driving.