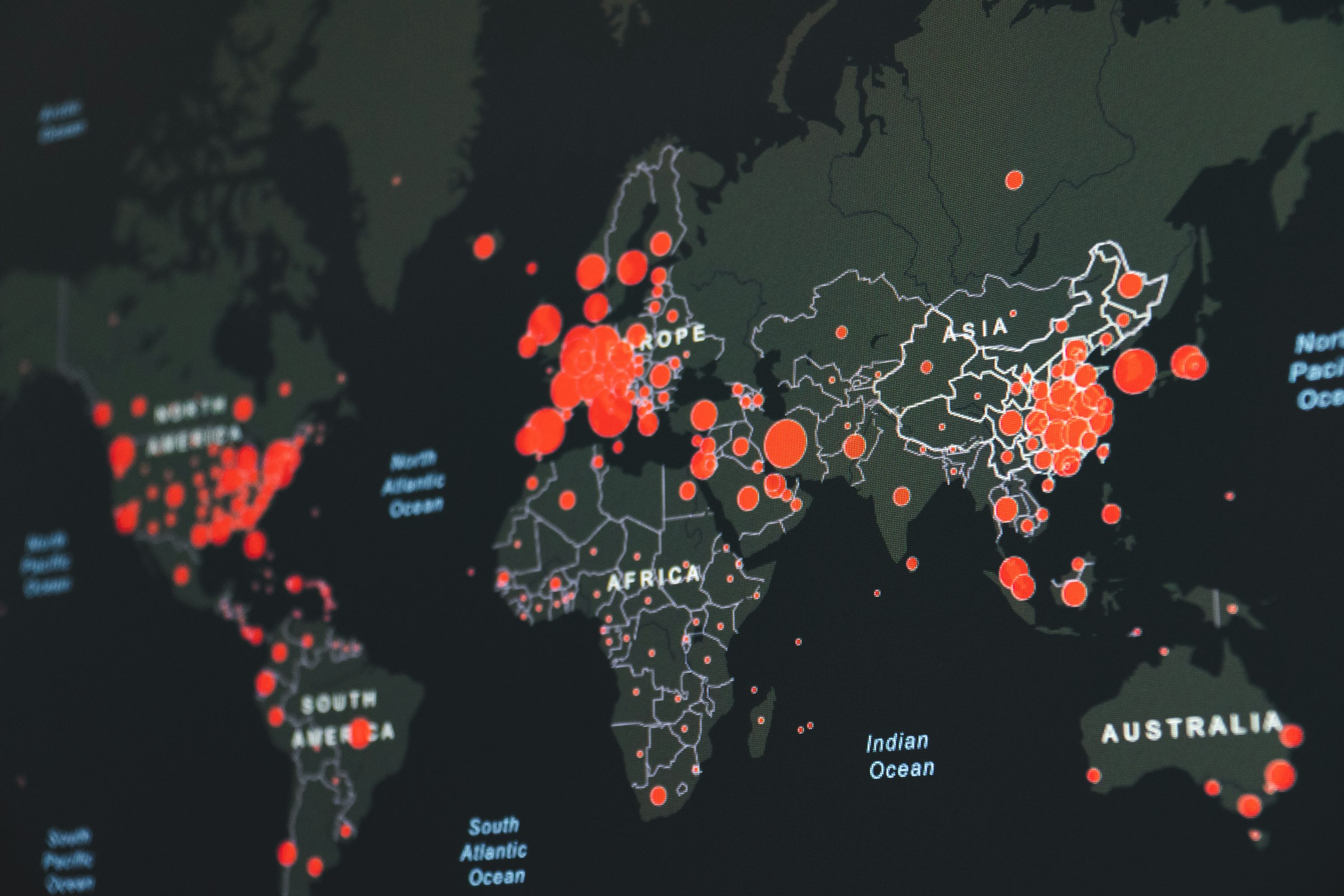

In today's era of highly developed globalization, a sudden epidemic can sweep across the world in a short time, causing a devastating blow to human life and health, economic order and even social stability. From Ebola to bird flu, from Zika virus to Covid-19, every epidemic outbreak has made us deeply realize that in addition to a strong public health system, a special risk transfer tool-epidemic insurance is gradually becoming an indispensable financial shield for governments, enterprises and individuals in the face of such disasters.

The birth of epidemic insurance is not accidental, it is the product of active innovation by the insurance industry after deeply understanding the growing global epidemic risk. Traditional insurance often focuses on the risk protection of individuals or specific property, while epidemic insurance focuses on a larger risk category-a wide range of chain crises caused by epidemics. When an epidemic occurs, the medical system is overloaded, enterprises stop production, employees face the risk of unemployment, and the financial pressure of the government increases sharply. At this time, epidemic insurance is like a ray of light to illuminate the darkness. It can provide financial support for medical treatment, ensure that patients get timely and effective treatment, and prevent high medical expenses from becoming a huge obstacle between people and their hopes for survival.

For enterprises, epidemic insurance is a key guarantee to maintain operations. Enterprises are faced with multiple dilemmas such as employees' inability to get to work due to illness, supply chain interruption, and sudden drop in market demand. The claims of epidemic insurance can be used to pay employees' wages, maintain necessary operating expenses, adjust production and operation strategies, and help enterprises to maintain their operation under the shadow of epidemic and wait for the dawn of market recovery. Take a multinational manufacturing enterprise as an example. When it was hit by a large-scale epidemic, many of its factories were forced to shut down. However, with the epidemic insurance purchased before, the enterprise obtained enough funds to maintain its basic operations, avoiding the fate of bankruptcy, providing employees with sustained economic security and reducing social unrest.

From a personal point of view, epidemic insurance provides an umbrella for individuals and their families. Once an individual is infected with an epidemic, he will not only face high medical expenses, but also lose his source of income due to long-term treatment and rehabilitation. Epidemic insurance can pay medical expenses and provide income compensation for individuals, so that patients can receive treatment with peace of mind without worrying about financial difficulties, and at the same time, it also guarantees the quality of life of family members and will not fall into the abyss of poverty because of one person's illness.

However, the development of epidemic insurance is not smooth sailing. Due to the complexity and uncertainty of epidemic diseases, how to accurately assess risks and formulate reasonable premium and claim terms is a huge challenge for the insurance industry. However, with the continuous integration of advanced technologies such as big data and artificial intelligence, as well as the deepening of research on the law of epidemic spread, epidemic insurance is gradually improving. Insurance companies can use big data to analyze global epidemic historical data, population movement information, public health prevention and control measures and other factors, evaluate epidemic risks more scientifically, and formulate more targeted and feasible insurance products.