In the realm of wealth, where businesses flourish and property holdings grow, the threat of risk becomes more pronounced. Wealthy individuals frequently navigate a tricky situation, with their personal and business assets closely linked. Here, insurance appears as a complex but frequently underestimated tool for protecting their wealth.

Unveiling the Power of Insurance Trusts

A strategy that is not widely recognized is the use of insurance trusts. Picture a situation where a successful business owner encounters unexpected challenges that result in bankruptcy. If they had previously placed their insurance policies into a trust, this would create a legal divide between their personal belongings and any possible debts. In several regions, assets kept in an insurance trust can remain safe even during bankruptcy or legal claims. This legal barrier not only guards the insured amount but also protects any future benefits. Consider a wealthy person who established an insurance trust many years earlier; when creditors approached them due to their business collapse, the trust funds allocated for their family's future were protected, ensuring that their beneficiaries’ finances stayed secure.

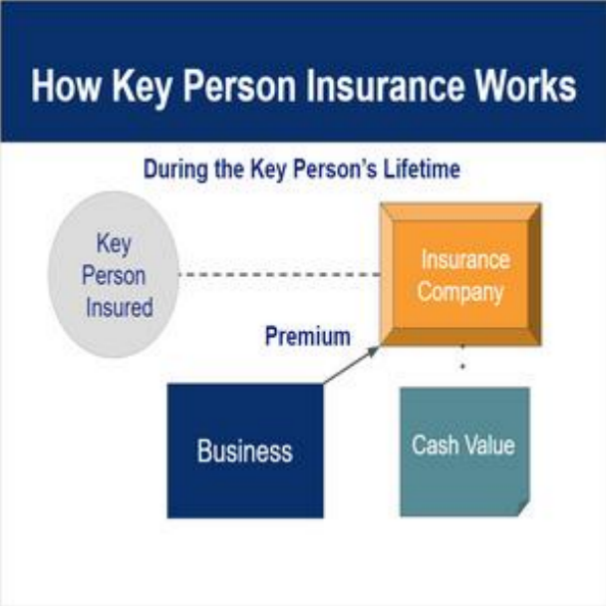

The Nuances of Key Person Insurance

In the business world, key person insurance is vital, although often overlooked. Consider a technology startup led by a forward-thinking CEO who is essential for inventing its groundbreaking products. If such an important leader were to leave, it could create major turmoil for the company, deeply impacting its financial health and value in the market. Key person insurance serves as a financial safeguard, offering resources needed to hire and train new leaders, maintain operations during shifts, and recover from lost income. In certain sectors, the unexpected exit of a key individual can cause stock prices to plummet by 30%. With key person insurance in place, the business is better equipped to handle these tough times, focusing not just on finding a replacement, but on ensuring its future success.

Real Estate: Beyond Traditional Coverage

For real estate investors, insurance is much more than just basic coverage for properties. One type, title insurance, is designed to safeguard against hidden problems with property ownership that can lead to expensive legal disputes. There was a well-known investor who bought a valuable commercial building, only to find out later that there was an old claim on the land. Fortunately, title insurance took care of the financial impact of fixing that issue. Furthermore, umbrella policies can be customized to address various liabilities tied to several properties, including injuries to tenants and environmental concerns. These all-inclusive policies provide a level of protection that standard insurance cannot offer, granting peace of mind to investors with large property portfolios.

Legacy Preservation Through Life Insurance

Life insurance serves more than just a safety measure; it acts as an effective tool for estate planning. Individuals with significant wealth can take advantage of whole life or universal life policies to ensure a reliable inheritance for their beneficiaries. For example, a successful business owner from a wealthy family arranged a whole life policy that allowed them to avoid probate. This decision led to a notable decrease in estate taxes, making it easier to transfer wealth to the next generation. Consequently, the family's financial legacy was preserved, and the business was able to succeed under new management. Ultimately, life insurance plays a crucial role in maintaining family legacies over time.

To sum up, insurance is a complex strategy for asset protection that offers much more than the basics. For individuals with substantial businesses and property, grasping these advanced insurance options can distinguish between keeping financial stability and dealing with unforeseen financial issues. It’s essential to view insurance not merely as a cost, but as a vital investment in protecting your hard-earned assets.