When wealthy people plan for their financial futures, the timing is crucial—particularly regarding insurance prices. The gap in costs between young adults and those in middle age is not simply a small difference; it represents a major chance to save money that grows over the years, matching well with the long-term wealth aspirations of high-income individuals.

The Actuarial Reality

The cost of insurance depends on actuarial science, which assesses risk using statistical data. Generally, younger individuals show less health risk, fewer existing medical issues, and the ability to hold policies for longer periods. These aspects result in cheaper premiums. On average, critical illness insurance for a 25-year-old is about 30-50% less expensive than for a 45-year-old with similar health conditions. When it comes to high-value life insurance, the difference can expand to 60% or beyond, since the risk of health issues tends to rise with age, increasing the potential costs for insurers.

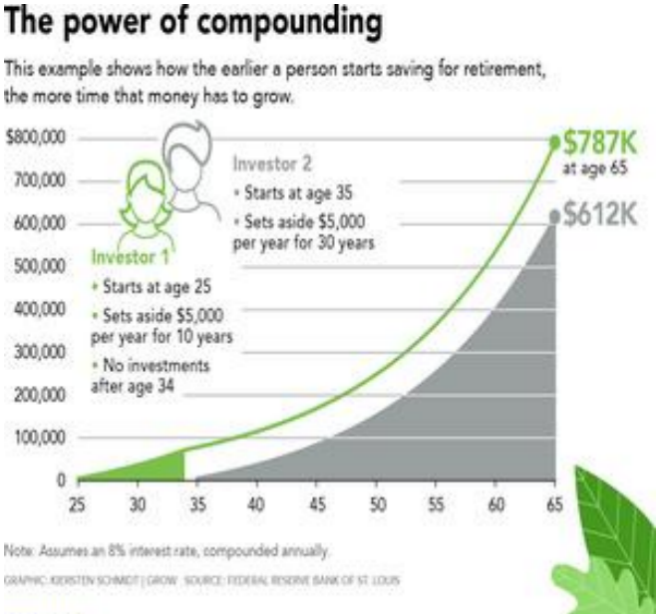

Compound Savings Over Time

The genuine financial benefits of getting insurance early go beyond the first premium payments. Securing lower rates in your 20s or 30s results in a compounding effect that later buyers miss out on. For instance, a $2,000 premium at age 25, which rises slightly with inflation, is much more advantageous than a $4,000 premium beginning at 40 when you look at total lifetime expenses. For those with high incomes who expect good investment returns, this is an instant “guaranteed return” since it helps avoid paying higher premiums in the future—funds that could be invested in businesses or portfolio expansion instead.

Health Decline and Policy Access

In addition to expenses, being young keeps some insurance choices that might not be available later on. Many wealthy people start to face health issues related to their lifestyle by their 40s, such as high blood pressure, high cholesterol, or joint pain. These issues can make insurance costs higher or limit what is covered. Getting a policy early helps secure coverage before these health problems arise, providing full protection no matter how health might change in the future. This is especially important for specific insurance types like international health plans or high-value life insurance, where health assessments become much more difficult after the age of 40.

Strategic Timing for Life Stages

Younger individuals with high incomes often ignore insurance while they build their careers, thinking it can be postponed until they have more responsibilities. However, waiting can lead to missed opportunities. When permanent life insurance is bought early, it not only offers lower premiums—something wealth managers value for its tax benefits and potential growth in cash value—but it also enhances the policy's financial benefits over time. For those whose income is on the rise, starting with an affordable plan allows for gradual increases as their wealth and obligations grow, keeping the ratio of premiums to income at manageable levels.Taking advantage of lower rates when young is not just about saving money; it is a smart financial decision. For those who are careful with their choices, buying insurance early helps safeguard both their health and their wealth, making age a positive factor instead of a drawback in their financial strategy.