For wealthy individuals dealing with complicated insurance options, it is essential to differentiate real value from mere marketing talk. With advanced plans that claim to offer various benefits, such as protecting wealth or providing international healthcare, taking time to carefully examine a policy can help avoid expensive errors. Learning to do this well makes it easier to understand confusing details, leading to smart financial choices that meet actual requirements, rather than simply responding to sales tactics.

The Critical Trio: Coverage, Exclusions, Limits

Every policy has its real worth hidden in three sections that require prompt scrutiny. First, examine the “Coverage Overview,” usually located within the opening pages of the policy. For wealthy clients, this goes beyond simple death benefits or healthcare provisions; it includes finding unique features such as emergency services abroad, luxury recovery options, or business interruption insurance that justify higher premiums. Be on the lookout for exact figures or percentage limits; ambiguous terms like “full coverage” often conceal limits.

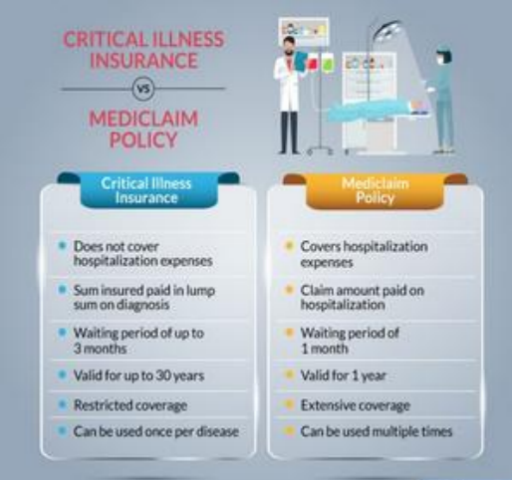

Then, turn your attention to the “Exclusions and Limitations” section. Here, you’ll discover what is not included, and it’s crucial since sales talks might skip over important information. High-value policies might exclude certain risky pursuits often associated with affluent lifestyles, like private flying or adventure sports, or may impose waiting times for critical illness claims based on hereditary factors. Pay close attention to time-related limits, as some policies may postpone full benefits for 2-3 years after purchase, creating gaps in essential early coverage.

The Fine Print on Fees and Flexibility

Wealthy investors recognize that fees can reduce their overall returns, and this applies to insurance policies as well. In the section labeled “Charges and Deductions,” look for recurring expenses such as mortality charges, administrative fees, and investment management fees associated with hybrid products. For high-premium policies, an undisclosed annual fee of just 1% can significantly diminish six-figure amounts over several decades. Compare these costs with the “Surrender Charges” schedule, where hefty penalties for ending a policy early often keep clients locked into underperforming plans.Additionally, flexibility is crucial, particularly for active high-net-worth individuals. Review the “Policy Adjustments” clause for options that allow you to boost coverage without needing new underwriting, lower premiums during career gaps, or tap into cash value via loans without having to surrender the policy. These aspects set customized policies apart from standard ones, but sales presentations often overlook them unless highlighted by clients.

The Clarity Test & Due Diligence for Insurance Policies

To start, conduct two quick evaluations: Can you express the main advantage in a single sentence? Does it meet your unique needs, such as business succession or family trusts? If you're a global user, check for "worldwide" coverage, and pay attention to exclusions, pre-authorization rules, and how currency fluctuations are managed.For a more thorough examination, match exclusions to your lifestyle, like marine coverage for boaters or cyber liability for business owners. Also, assess the triggers for benefits: does critical illness coverage depend on particular diagnoses or are general functional impairments considered?Insightful policies benefit from careful analysis. Look closely at the details, potential hidden limits, and flexibility to transform documents into instruments that protect your wealth, lifestyle, and legacy while steering clear of empty sales pitches.