Thinking that "Medicare is enough" misses the complicated relationships involved in paying for healthcare. For those who spend a lot, it is important to grasp the differences between Medicare, health insurance, and critical illness insurance to create a strong plan for protecting both health and finances.

Coverage Scope: Where Gaps Emerge

Medicare serves as a crucial safety net, but it has notable drawbacks. The program mainly supports hospital admissions and basic outpatient care, leaving out many valuable treatments. For example, immunotherapies for cancer that are still being tested typically aren't included. Comprehensive private medical insurance helps to address these shortcomings, offering coverage for a wide range of services, from urgent international medical evacuations to alternative treatments like stem cell therapy. Wealthy individuals often seek medical care abroad, and private insurance allows them to access top-notch facilities worldwide without financial burden.

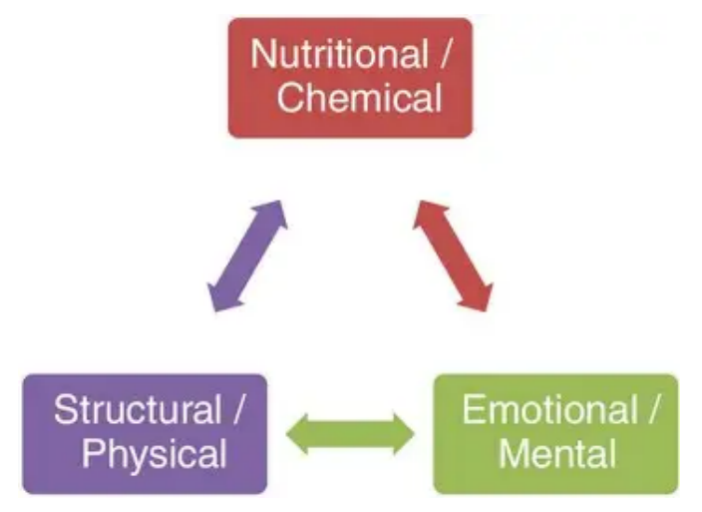

On the other hand, critical illness insurance functions differently. Rather than paying for medical expenses, it gives a one-time payment when someone is diagnosed with serious conditions like heart attacks or strokes. This financial support is not restricted to medical costs; policyholders can utilize it for various needs, such as covering mortgage payments during their recovery, hiring nurses to assist at home, or investing in wellness retreats for healing. It effectively addresses the financial strain that serious illnesses can cause, something that Medicare and standard insurance plans often overlook.

Payout Mechanisms: Liquidity vs. Reimbursement

The way payments are handled sets apart these three aspects. When providers deliver services, Medicare pays them later, which often leads to significant delays in processing. This situation can put a strain on cash flow, especially for costly procedures. Medical insurance generally operates on a similar reimbursement basis, but certain premium plans may allow for direct hospital billing, which lowers initial costs. In contrast, critical illness insurance provides immediate cash. After a diagnosis, a lump-sum payment is made within days, offering financial ease right at the moment it is most essential. For business owners or leaders, this rapid influx of cash can help avoid disruptions during prolonged absences.

Service and Experience: The Luxury Factor

Individuals with high spending habits value high-quality care and service. However, Medicare's standard coverage does not provide for tailored healthcare experiences. On the other hand, high-end health insurance plans include concierge services, quicker access to top specialists, and reduced wait times. Some options even feature wellness services such as customized nutrition advice and exercise coaching.

Although critical illness insurance doesn't directly relate to medical services, it significantly improves the overall healthcare experience. The financial protection it offers allows policyholders to concentrate on their recovery without the burden of financial concerns. This freedom enables them to select the optimal treatment options without worrying about expenses, enhancing their power to make informed healthcare decisions.In summary, Medicare, health insurance, and critical illness insurance work together, each playing a vital role. For those capable of investing in broad coverage, depending only on Medicare can be a dangerous mistake. By combining these three aspects, wealthy individuals can secure both health-related and financial stability when facing medical challenges.