For people in middle age who have more money to spend, the combined demands of paying for their children's education and looking after elderly parents can be very tough. To manage this difficult time, it’s essential to carefully plan how much insurance to buy, and this requires more than just usual advice.

Prioritizing Education: Beyond the Tuition Fees

When providing insurance coverage for children, it’s important to consider more than just basic education costs. Families with significant wealth often seek prestigious educational opportunities, which can require substantial financial resources. It’s wise to explore education insurance plans that act like endowments, as they cover not only tuition but also expenses related to extracurricular activities, study abroad programs, and even further education after graduation. For example, a student aiming for an Ivy League school might need funding for SAT preparation, guidance from application experts, and travel for campus tours.

In addition, consider adding riders to protect against disruptions in their education. Including a rider for critical illness or accidents can provide a significant payout if a child faces a health crisis that impacts their studies. This financial support can be utilized for medical care, recovery services, or bringing in private tutors to help them keep up with their learning.

Securing Elderly Care: A Comprehensive Approach

For older parents, standard health insurance might not provide enough support. High-quality long-term care insurance is crucial in such cases. These plans can cover various services, including in-home nursing and assisted living options. Some insurance even offers care specifically for dementia, which is increasingly vital as more people age.Instead of choosing a generic plan, tailor the coverage to fit your parents' health needs and way of life. If they want to stay in their own home, select a plan that has a generous allowance for home care. If you have brothers or sisters, consider adding a "shared care" option. This would let family members combine their long-term care benefits, enhancing support for everyone involved.

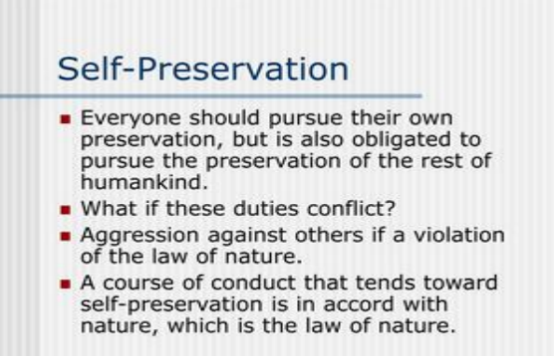

Self - Preservation: The Foundation of Family Security

Middle-aged people often ignore their need for extensive insurance coverage. It’s essential to have life insurance that offers a significant death benefit, but it’s equally important to consider policies that include living benefits. For instance, universal life insurance builds cash value over time, which can be used during your life for unexpected costs, like income loss during a job change or to boost your retirement savings.Disability insurance also plays a crucial role. If you face a long-term disability, it can provide a large part of your income, helping you to pay for your children's education and care for your parents. Look for a policy that replaces at least 60-70% of what you earned before becoming disabled.

Dynamic Allocation: Adapting to Life’s Changes

Deciding how much insurance coverage you need is not a choice to make just once. It's important to frequently reassess your policies as your children age, your parents’ health changes, and your financial situation shifts. Utilize advanced financial planning tools to envision various scenarios. For instance, consider how a drop in the market could affect education plans that depend on investments or how a family health emergency might strain your financial resources.

During the complexities of middle age, distributing insurance amounts wisely is crucial for wealthy families. By embracing a comprehensive, personalized, and adaptable strategy, you can ensure the protection of every family member, no matter what surprises life might bring.