In the fast pace of urban life, as a "harbor" for car, private garage's safety can not be ignored. Private garage insurance, which seems to be a niche but vital insurance, is gradually coming into people's field of vision, supporting a solid "umbrella" for garages and vehicles.

In many foreign regions, private garage insurance has been widely used. In Germany, the market penetration rate of private garage insurance is extremely high. Germans have almost strict requirements for garage safety. An unexpected garage fire may affect many expensive vehicles, causing incalculable losses. However, with private garage insurance, car owners can feel at ease. Insurance companies not only bear the cost of repairing the garage damage caused by accidents such as fire, theft and flood, but also compensate the loss of vehicles in the garage. In Italy, private garage insurance also covers the risk of vehicle access damage caused by garage door failure. The garage doors in some old residential areas in Italy are very old and have frequent mechanical failures. When the vehicle is accidentally scratched by the garage door when entering or leaving the garage, the relevant rules in the insurance clauses ensure the considerate compensation of the owner and reduce the contradictions and disputes between the owner and the garage management.

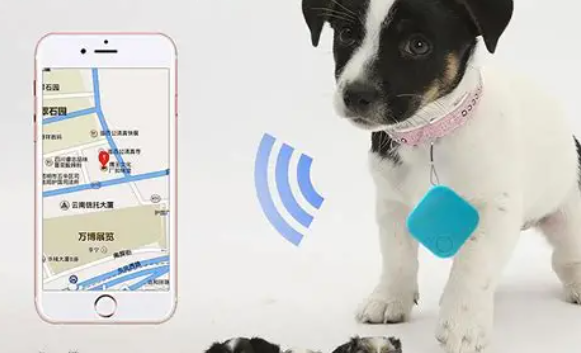

The coverage of private garage insurance is surprising. In addition to common risks such as natural disasters, theft and accidental impact, it also extends to the damage of facilities in the garage. In the United States, private garages are often equipped with advanced automatic lighting systems and ventilation equipment. Once these devices fail, the insurance can support the maintenance cost within a certain amount. At the same time, the convenience of the insurance claims process is also constantly improving. Many insurance companies have opened online claims channels, and car owners can complete the steps of reporting, uploading damaged photos and providing relevant certificates through mobile phone applications. In Britain, after the owner experienced this convenient process, the average claim period was shortened by nearly one week, greatly reducing the inconvenience of the owner during the period of vehicle damage.

In Asia, Japan's private garage insurance is also unique. There are many earthquakes in Japan, and the garage structure is vulnerable to earthquakes. Japan's private garage insurance specifically covers earthquake risks and provides compensation for garage and vehicle damage caused by earthquake. Moreover, the insurance company will tailor the insurance plan for the owner according to the building structure and geographical location of the garage, so as to make the insurance protection more accurate and effective.

When purchasing private garage insurance, car owners should comprehensively consider the actual situation of their own garages, the risk characteristics of their areas and the value of their vehicles. Reasonable allocation of insurance amount and insurance combination can protect our own interests to the greatest extent when accidents strike. Private garage insurance is not only the protection of material property, but also the protection of peace of mind and tranquility for car owners, so that every parking has no worries.